Your Path to Financial Inclusion

Invest in the Future of Real Estate with FraXion

Unlock generational wealth through FraXion’s blockchain-powered real estate STO, offering digital assets backed by some of the most sought after mixed use and public/private partnership real estate development projects in the US.

Investor-Centric Philosophy

FraXion democratizes real estate investment, introducing accredited investors to the institutional world.

By aggregating smaller investments, we surpass minimum capital requirements and enable you to participate in high-value projects previously reserved for institutions.

Unique Access

The first debt security token that gives accredited investors the opportunity to invest alongside institutional investors and top-tier real estate developers with over 75 years of combined experience and $10 billion+ of current and completed real estate development projects.

Provide Liquidity

We have finally developed a method to allow for liquidity in real estate investment. Security tokens can be traded, subject to transfer restrictions, reducing risk and increasing financial flexibility for investors.

Empowering Investors

Expect to receive an interest payment of 10% per annum (accrues and is paid out at maturity), PLUS a share of the equity appreciation of the underlying real estate.

“FraXionalization”

Tokenization of real estate allows assets to be owned by more investors, similar to owning shares of stock in a corporation.

Access. Diversification. Risk Mitigation.

Our model focuses on aggregating the investment capital of many, but investing as one.

Institutional level real estate investing has traditionally locked out the retail accredited investor due to very high minimum investment requirements. FraXion is the gateway that bypasses this roadblock.

By pooling the investments of many smaller investors, FraXion token holders can now collectively meet the higher minimums required to invest in some of the best institutional level real estate development projects in the US.

Top Targeted Developers

The multibillion dollar real estate portfolios of our chosen developers are very much diversified, and that diversification is passed through to our token holders.

THE PEEBLES CORPORATION

The Peebles Corporation is a privately held national real estate investment and development company specializing in residential, hospitality, retail and mixed-use commercial properties. The company has corporate offices in New York City, Miami, and Washington D.C.

ROYAL PALM COMPANIES

Royal Palm Companies focuses on the trifecta of location, design and delivering a superior product. A scalable practice from the single-family home to some of the countries largest mega-mixed use projects, RPC regularly outperforms the market.

Empowering Investors

FraXion’s debt offering empowers us to act as the intermediary between you and the developers.

Your investment earns a solid 10% per annum floor with the potential for unlimited upside based on project performance.

It’s a five-year commitment, leading to both stability and potential for impressive growth.

Tokenization is the future of real estate, and we're at the forefront

While some confuse our security tokens with cryptocurrencies, know this: our tokens are backed by tangible real estate assets and meticulously regulated to ensure safety and compliance.

There are no “smoke and mirrors” here. We’re leading the way, bringing real value to the blockchain revolution.

Your Ticket to Exclusive Access

FraXion grants you access to the lucrative world of public-private partnerships and mixed-use developments led by distinguished developers. The likes of Donahue Peebles (www.peeblescorp.com) and Daniel Kodsi (www.rpcholdings.com) welcome you to their projects, setting the stage for generational wealth.

Unlocking Opportunities, Building Wealth

At FraXion, we’re not just disrupting the real estate market – we’re revolutionizing it. Our story indirectly began two decades ago when founders Demetrius Ford and Nathan Burrell united with a shared vision: empowering women, minorities and individuals with limited access to capital and resources.

Nathan’s tech prowess, combined with Demetrius’ financial acumen, led us on an incredible journey, resulting in a groundbreaking solution – FraXion’s Security Token Offering (STO).

FraXion emerged as a vehicle to bridge the gap between discerning investors and top-tier developers. Today, we’re proud to present our relationship with these renowned developers – a testament to our credibility and dedication to excellence.

The Power of Inclusion

We stand as a beacon of inclusion and opportunity, transforming the real estate landscape for both investors and developers.

As we forge ahead, expanding our offerings and embracing innovation, remember: your journey begins with FraXion.

FraXion Management Team

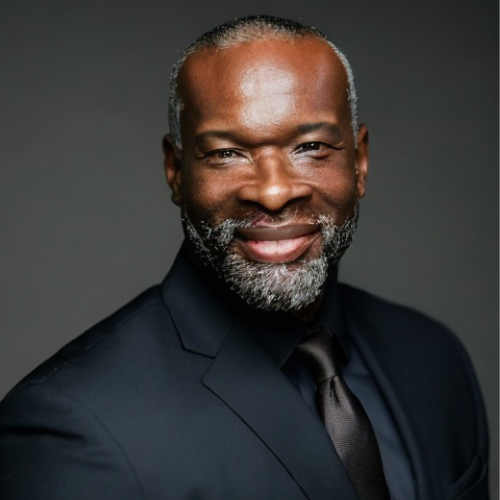

Managing Director, Digital Assets

Demetrius Ford

Mr. Ford brings more than 25 years of experience in corporate finance, business development, sales, marketing and entrepreneurship. Demetrius has successfully assisted in raising more than

$50 million for both public and private companies and has held the position of Director of Investor Relations for several publicly traded companies. Licensed as a Series 24 (Securities Principal) and Series 7 (Registered Representative), Mr. Ford started in the securities industry as a stockbroker, but quickly rose through the ranks, earning promotions to Compliance Officer, Sales Manager and Branch Manager.

Mr. Ford eventually started his own investment banking firm in 1997, and in 1999, he founded M2M Capital Corporation, a company focused on assisting minority and women owned businesses with access to corporate finance, business planning and mergers and acquisitions.

In 2004, Mr. Ford formed Trinity Sports and Entertainment Group and through that entity, acquired the rights to the Miami ABA (American Basketball Association) professional basketball franchise, and named the team the Florida Pit Bulls. In a move that shocked the basketball world, Demetrius then lured 5-time NBA All Star and Hall of Famer Tim Hardaway out of retirement to be the team’s starting point guard, head coach and general manager.

Demetrius served his country honorably, both in the US Navy (1984-1988) and in the US Marine Corps (1990-1994), being honorably discharged from both branches of service. He received his bachelor’s in Business Management from Barrington University while serving in the US Marine Corps.

Managing Director, Real Estate

NATHAN BURRELL

Nathan is a social innovator with unique experience in both the public and private sectors. He has over 20 years

of experience in business, entrepreneurship and real estate. He is currently broker/manager of Randolph &

Main Realty Group, LLC., which specializes in residential and commercial real estate services and investments.

He is also the founder and director of Helping Our Nations Empowering Youth Ventures, Inc. (HONEY Ventures),

an enterprising nonprofit organization that promotes economic development through the effective utilization of

technology and social enterprise.

In 2000, he created and launched the VirtuPass Corporation, an alternative payment platform company that provided secure and anonymous online transactions.

As president and CEO, Mr. Burrell successfully guided the

company from start-up, seed and 1st round capital acquisition to product launch. Nathan is called a “Social

Entrepreneur” and has won numerous awards for his community involvement and outreach, such as the “Sister

Cities International Innovation: Youth and Education” Award. As an author, speaker and entrepreneur, Nathan

has a desire to inspire and empower people to fulfill their God-given purpose and destiny in life. He believes

that no one is worthless and can make a difference now, no matter their age or station in life.

Nathan was appointed as a Digital Divide Council Member for the State of Florida and was a Board Member of

Greater Ft. Lauderdale Sister Cities International. He is a former member on the Board of Governors for Keiser

University and served on the Board for Junior Achievement South Florida. Nathan holds a Bachelors degree in

Business Administration with a concentration in Marketing from Jacksonville University.

Chief Financial Officer

Rashidah Billups

A finance and technology professional for over 15 years, Rashidah “Roz” Billups is a leader in advancing Diversity, Equity & Inclusion in community development finance (CDF), an industry that serves many Black and Latinx communities yet remains seriously under-represented by BIPOC professionals. She is the inaugural executive director of Open Access, a national nonprofit organization launched in 2020 to increase representation and leadership of Black and Latinx professionals in all facets of CDF including real estate, construction, accounting, legal, underwriting, architecture, and development.

Rashidah was chosen for her experience, her commitment to expanding opportunities, and her leadership and advocacy skills. Herself a graduated Fellow of Open Access, today, in collaboration with its co-founders, she operates the organization on all levels: selecting fellowship candidates and placing them with sponsors, interacting with fellows and sponsors, sponsor recruitment, launching a capital campaign, organizing networking events and promoting and increasing alumni engagement. Rashidah has spoken at conferences and events nationwide to heighten awareness of the lack of DEI in the industry and has inspired companies to take action. Rashidah holds a B.S. in finance from William Paterson University and C-Tech & CISCO certifications in fiber optics and network cabling. She studied abroad at Cambridge University, exploring intellectual property rights in the US, UK and China, and was Assistant Vice President at Bank of America Merrill Lynch. Currently, as an advisor to startups through her own firm, Park Place Consultants, Rashidah secured funding enabling companies to develop innovative, non-traditional products including the newly minted FraXion Token and FraXion Marketplace.

Executive Director

Anthony R. Morgenthau

Anthony R. Morgenthau brings more than five decades of proven success in the areas of investment banking, tax and estate planning, oil and gas exploration, real estate investing and venture funding of early-stage companies.

For the past 50 years, Mr. Morgenthau has been an investor, and involved in management and operation of companies in several industries. It is his diversified experiences that gives FraXion a unique perspective in evaluating investment opportunities and a pipeline to many people that can help their investments reach their objectives.

He founded Morgenthau and Associates (a FINRA Broker Dealer) in 1973 and was the firm’s financial principle registered with the SEC. He formed ARM Holdings, LP in 1997 and in 2006 Anthony founded and funded the Morgenthau Accelerator Fund, LP.

In 2001 Mr. Morgenthau along with his wife Beth Ann founded and were actively in volved in the day-to-day management of BAM Racing LLC, a NASCAR race team.

Currently, Mr. Morgenthau serves in various capacities with multiple companies. For the past 20 years Mr. Morgenthau has been on the board and a major investor in CTRL Systems Inc. He is the co-founder and on the board of B&T Technologies Inc ( a Food Waste To Animal Feed Company). He is the founder and manager of Hyperion Solutions Inc. ( a cannabis producer and laboratory). He is the co-founder Randolph & Main Capital Group, LLC and sits on its board of managers (a Real Estate Investment Company). He received his Bachelor’s degree from Westminster College.

FREQUENTLY ASKED QUESTIONS

A Security Token Offering (STO) is a method of raising capital in exchange for value, such as equity, debt, or asset-backed securities. Investors are issued tokens as a representation of their investment.

Currently, FraXion can only be purchased with fiat currency.

Fraxion is a unique, smart token that provides an exceptional combination of security, high base rate of return, and an equity participation component that offers additional, unlimited upside potential. Equally, if not more important, it provides the flexibility of liquidity, which is virtually unheard of in institutional-grade real estate investing.

Copyright © 2023, RMCG Digital Holdings I, LLC. All rights reserved

THIS SITE IS OPERATED BY RMCG DIGITAL HOLDINGS I, LLC, WHICH IS NOT A REGISTERED BROKER-DEALER OR INVESTMENT ADVISOR. RMCG DIGITAL HOLDINGS I, LLC, DOES NOT PROVIDE INVESTMENT ADVICE, ENDORSEMENT OR RECOMMENDATIONS WITH RESPECT TO ANY PROPERTIES LISTED ON THE THIS SITE. NOTHING ON THIS WEBSITE SHOULD BE CONSTRUED AS AN OFFER TO SELL, SOLICITATION OF AN OFFER TO BUY OR A RECOMMENDATION IN RESPECT OF A SECURITY. YOU ARE SOLELY RESPONSIBLE FOR DETERMINING WHETHER ANY INVESTMENT, INVESTMENT STRATEGY OR RELATED TRANSACTION IS APPROPRIATE FOR YOU BASED ON YOUR PERSONAL INVESTMENT OBJECTIVES, FINANCIAL CIRCUMSTANCES AND RISK TOLERANCE. YOU SHOULD CONSULT WITH LICENSED LEGAL PROFESSIONALS AND INVESTMENT ADVISORS FOR ANY LEGAL, TAX, INSURANCE OR INVESTMENT ADVICE. RMCG DIGITAL HOLDINGS I, LLC, DOES NOT GUARANTEE ANY INVESTMENT PERFORMANCE, OUTCOME OR RETURN OF CAPITAL FOR ANY INVESTMENT OPPORTUNITY POSTED ON THIS SITE. BY ACCESSING THIS SITE AND ANY PAGES THEREOF, YOU AGREE TO BE BOUND BY THE TERMS OF SERVICE AND PRIVACY POLICY. ALL INVESTMENTS INVOLVE RISK AND MAY RESULT IN PARTIAL OR TOTAL LOSS. BY ACCESSING THIS SITE, INVESTORS UNDERSTAND AND ACKNOWLEDGE 1) THAT INVESTING IN REAL ESTATE, LIKE INVESTING IN OTHER FIELDS, IS RISKY AND UNPREDICTABLE; 2) THAT THE REAL ESTATE INDUSTRY HAS ITS UPS AND DOWNS; 3) THAT THE REAL PROPERTY YOU INVEST IN MIGHT NOT RESULT IN A POSITIVE CASH FLOW OR PERFORM AS YOU EXPECTED; AND 4) THAT THE VALUE OF ANY REAL PROPERTY YOU INVEST IN MAY DECLINE AT ANY TIME AND THE FUTURE PROPERTY VALUE IS UNPREDICTABLE. BEFORE MAKING AN INVESTMENT DECISION, PROSPECTIVE INVESTORS ARE ADVISED TO REVIEW ALL AVAILABLE INFORMATION AND CONSULT WITH THEIR TAX AND LEGAL ADVISORS. RMCG DIGITAL HOLDINGS I, LLC, DOES NOT PROVIDE INVESTMENT ADVICE OR RECOMMENDATIONS REGARDING ANY OFFERING POSTED ON THIS WEBSITE. ANY INVESTMENT-RELATED INFORMATION CONTAINED HEREIN HAS BEEN SECURED FROM SOURCES THAT RMCG DIGITAL HOLDINGS I, LLC, BELIEVES TO BE RELIABLE, BUT WE MAKE NO REPRESENTATIONS OR WARRANTIES AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION AND ACCEPT NO LIABILITY THEREFORE. HYPERLINKS TO THIRD-PARTY SITES, OR REPRODUCTION OF THIRD-PARTY ARTICLES, DO NOT CONSTITUTE AN APPROVAL OR ENDORSEMENT BY RMCG DIGITAL HOLDINGS I, LLC, OF THE LINKED OR REPRODUCED CONTENT.